One of the central claims is that shale gas production in the UK would bring down the price of bills in the UK. After all its claimed that shale gas brought down US gas prices. David Cameron himself was very keen to make this point, and several church groups seem to be backing away from the protests on grounds that it might help reduce fuel poverty.

But nobody, neither protesters nor the media nor the government seems to have paused for a second and fact checked. Did shale gas really bring down the price US wholesale gas prices?

The truth about US Gas prices

Below in figure 2 is the US Wholesale gas prices trend over the last few years. As you can see gas prices rose steadily over the summer and then autumn of 2007, before dropping dramatically after the financial crisis hit to reach its nominal historical levels.

This spike in prices is probably due to events back in the winter of 05/06, when a combination of a cold winter and hurricane damage to gas facilities in the gulf of Mexico almost led to the US running out of gas. Inevitably the spiv’s and speculators in Wall Street began speculating the same would happen again in the lead up to the 07/08 winter…until the economy fell off a cliff and they were sent running for cover.![Figure 3, Shale gas production growth rates in the US [Credit:Hughes (2013), based on EIA data]](https://daryanenergyblog.files.wordpress.com/2013/08/fig4_hughes_etal_2013_figure_40_us_shale_gas_2000_to_may_2012.png?w=448&h=293)

Figure 3, Shale gas production growth rates in the US

[Credit: Hughes (2013), based on EIA data]

Also its worth remembering that shale gas is not particularly “cheap” as gas comes. David Hughes, has pointed out that many US shale gas plays aren’t economic. As I mentioned in a previous article, Arthur Berman (a well known “insider” within the industry) has shown that many US gas plays are selling shale gas at below the market price. One has to question how dumping a lot of relatively expensive gas on the market is supposed to bring down prices.

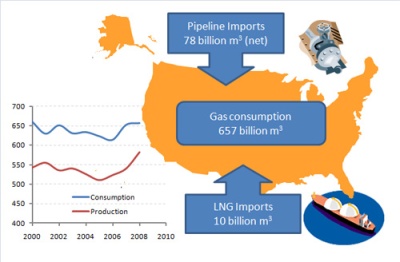

Its also worth remembering at this point that Shale gas represents only around about 37% of US gas supply (as I calculated here). The rest is conventional gas production, often linked to oil production (hence its price tends to fluctuate with the oil price) and imports. Indeed in the wake of the 2005 spike there was a major effort to increase facilities to handle gas imports, notably via pipelines from Canada and the LNG route. This probably had a much more significant impact on US gas prices as it effectively connected the US with cheaper gas overseas, notably from the Middle East region and Australia.

I’m not suggesting that shale gas has had no influence on the US gas market, clearly it has increased domestic supplies of gas (indeed, imports via LNG are now down significantly) and probably helped to avoid a ramp up of prices as the economy rebounded. But it certainly isn’t the sole factor determining prices. Gail Tverberg over on the “our finite world” blog discusses numerous other factors influencing US gas prices, such as a lack of storage capacity (forcing companies into a use it or loose it position) and a lack of take up by consumers, likely due to the weak state of the economy.

Suffice to say its better to look at the gas market as a concert orchestra, with Shale gas being one of the guys at the back with a Tuba. Claiming he’s responsible for all the music (as supporters of Shale gas will attempt to do) is to ignore the bigger picture. Then again, I’ve long pointed to the inability of climate deniers (who tend to be the same people as shale gas promoters) to interpret a graph and correlate issues of cause and effect.

High noon for US shale gas

But how long will any influence shale gas has on US gas prices last?

Probably not very long. Already the rig count for gas wells is dropping, although there has been a concurrent ramp up of oil drilling rigs. David Hughes has previously suggested that the bulk of US shale gas plays are not economic unless there is some oil based extraction (i.e. combined tight oil and gas extraction). This trend in rig counts is probably representative of drilling shifting from the shale gas basins over to shale oil and tight oil extraction.

David Hughes also suggests that shale gas production has already plateaued and shale oil production will peak sometime around 2017, an idea the EIA now seems to support. And again, as I discussed before shale gas can only realistically provide a small fraction of the current US energy demand (at most 8.6% of total US energy consumption).The latest EIA figures suggest just 10 years of shale gas reserves at current extraction rates (they give a figure of 97 Tcfg here or 1,931 mtoe, current production is 26 Bcfg/day or 189 mtoe per yr, 1931/189 = 10.2 yrs) with a likely peak of US shale gas production sometime before 2015. The EIA haven’t quite come around to this one, as they seem to be holding out for a proven reserves increase, even thought they themselves have been cutting shale gas reserve forecasts quite drastically for sometime now. Also even taking the highest available speculative value for shale gas reserves in the US, 567 Tcfg (note, unproven reserves, just a best guess, courtesy of the EIA), would only sustain present US gas demand (25.5 Tcfg/yr last time I checked) for 22 years. Thus shale gas is looking like it will represent but a small temporary blip in the US energy market.

Meanwhile back in Blighty…..

But that’s America, what about the UK?

Well its worth noting that even the shale gas drilling companies were, until a few weeks ago, claiming that drilling would have no influence on prices. As this article in IBTimes highlights, the primary justification for shale gas drilling in the UK has always been about security of supply.

Of course even this “security of supply” concept is also somewhat dubious. As Tom Brown, a Senior Credit Executive at Norddeutsche Landesbank (hardly fluffy tree huggers!), highlighted in a recent letter to the Financial Times, there are many reasons to doubt both the economic arguments in favour of shale gas but also the security of supply argument. As he puts it:

“As for energy security, it is absurd to imply that gas extracted from the Norwegian sector of the North Sea is less secure than from the UK sector, unless you expect FT readers to believe that Norway could be overthrown by a hostile regime”

Just do the maths!

Furthermore, I would point to a UK parliamentary report which suggests that UK shale gas reserves are about 150 billion m3 (about 1,318 billion kWh‘s worth of energy). Sounds like a lot, until you realise that current UK gas consumption is around 857 billion kWh’s/yr. Total UK energy consumption incidentally is around about 205 mtoe (million tonnes of oil equivalent) or about 2,563 billion kWh’s/yr.

Thus, even if we could extract all of that shale gas (which we won’t) and we could extract it all at some arbitrary rate of our choosing (which we can’t), it would supply only 1.5 years worth of gas and (neglecting cycle efficiencies, i.e. assuming 100% conversion and no losses or leaks) it could only meet UK energy demand for about 6 months. Hardly much of a “solution” to the UK’s energy problems. Indeed if shale gas in the US is a lone Tuba in the Orchestra, in the UK it would appear to be the bored looking guy at the back with the little triangle.

And contrary to what you’ll hear from some sources, shale gas will not reduce carbon emissions, as there is good evidence to suspect it might have a higher carbon footprint than conventional gas resources. Indeed it might even be worse than coal. Finally, there are a host of other environmental, economic and practical arguments against shale gas , which businessgreen.com considers here.

All hot air?

In short if there’s one thing we can say about shale gas is that there’s likely to be more hot air extracted from the hype and spin about it than we ultimately get from the gas itself! The only people who will gain are the a small number drilling companies with dollar signs in their eyes. Belief in shale gas and its magical properties is starting to take on elements of myth and legend, its a bit like believing in the tooth fairy.

Certainly, if “security of supply”, reducing price volatility and reducing coal consumption are one’s true objectives, I would point in the direction of renewable energy sources. As every pound invested here will have a much more direct influence on these goals than that same pound invested in shale gas.

![Figure 1, Shale Gas protests UK [credit: Yahoo News & Associated Press, 2013]](https://daryanenergyblog.files.wordpress.com/2013/08/47e6bd01c644d81b3a0f6a70670062be.jpg?w=512&h=303)

![Figure 2, US wholesale natural gas prices [EIA, 2012 & lngworldnews.com]](https://daryanenergyblog.files.wordpress.com/2013/08/eia-shale-resources-contribute-to-growth-of-natural-gas-production-usa.jpg?w=512&h=357)

![Figure 5, Natural Gas drilling rig counts in the US [credit: Baker/Hughes Inc & Yahoo.com, 2013]](https://daryanenergyblog.files.wordpress.com/2013/08/have_nat_gas_rig_counts-9c5e4ffbcf5e8d8b0d23cf2e3f0947af.jpg?w=640)

I’m afraid that as an amateur in these matters, my brain hurts in converting tcf to cu m to Twh etc. However the BBC reports that our current consumption of natural gas in the UK is about 3 tcf per year. Therefore shale gas reserves represent a significant multiplier over consumption (perhaps 50 years or more). Not the 6 months which you suggest. Do you agree and does this change your views on the significance and dangers of this energy source to the UK’s Climate Change obligations?

The 150 billion m3 figure I quote comes from a UK parliamentary report, which also points out that this is just 1.5 years worth of NG at present consumption levels.

http://www.publications.parliament.uk/pa/cm201011/cmhansrd/cm111103/halltext/111103h0001.htm#11110367000003

The 857 Billion kWh/yr of NG and the overall UK energy consumption figure both come from the DUKES report, an annual DECC and Office for National Statistics publication.

https://www.gov.uk/government/publications/natural-gas-chapter-4-digest-of-united-kingdom-energy-statistics-dukes

Even so, you’re figure (for which you provide no reference, nor I suspect do the Beeb) of 3 TCF converts into 85 Billion m3 of NG:

http://www.convertunits.com/from/cubic+meter/to/cubic+foot

150/85 = 1.76 years, slightly higher than the DUKES or Parliamentary estimate, but I suspect the Beeb figure is failing to account for internal system losses (or variations in SHC, etc.), which the other two (more reputable sources) are considering.

The 6 month figure I give relates to total UK energy consumption (i.e. gas, coal, oil, renewables, etc. the lot), although it neglects the crucial issue of cycle efficiencies (and is thus probably if anything an overestimate of Shale gas potential). i.e. NG in a boiler is about 90% efficient, 33-45% for a power station, while first compressing NG to fill a tank in a car will involve losses (20 – 30% depending on working pressure) then running a car engine at 25-30% efficiency will mean we need a lot more shale gas available at the start to do these tasks as compared to the amount of oil you’d need to do the same job.

Oh, and I nearly forgot, the major threat of shale gas as far as GHG’s are concerned is its much higher potential carbon footprint as compared to conventional gas extraction, as I discussed in a prior post.

Sorry to take time to follow up, but for some reason the UK government was off line as regards to providing information on important issues such as energy data.

You are correct to query my use of the BBC as a reference, so I have resorted to primary UK sources, namely the British Geological Survey (BGS) and DUKES.

As no doubt you know, the BGS in June 2013 made a substantial upwards revision in its estimate of shale gas in place for one area alone – Northern England. This post dates the parliamentary report to which you refer and indicates – dependent on exploitation rates etc. – many years of potential supply for the UK, based on the DUKES data.

If we discount the stuff about security of supply this could still equate to a lot of British jobs and tax revenues to the UK exchequer – which can translate into better services or reduced taxes. Maybe its difficult to demonstrate an effect on gas prices, but I know what hand I would rather play in a discussion about prices with the Russians.

However this leaves concerns about the environmental impact, particularly the high carbon footprint of shale gas as asserted by the Howarth et al paper to which you refer and which I have read with interest – is it true? If so, we have a clinching argument against the exploitation of shale gas.

BGS estimates

Again, you’d need to give me an exact reference so I know what you’re talking about. i.e. is this actual proven reserves, speculated reserves or estimates of shale gas in place? Its important not to get these figures mixed up as they mean very different things.

A number of cornucopian’s tend to focus on reports showing massive amounts of a particular resource and its potential, failing to understand that:

-The bulk of that gas/oil will likely never be extracted as its unlikely to be economically viable (or indeed technically possible) to do ever do so.

-There are vast amounts of conventional oil and gas that are typically ignored as far as reserve estimates, as it’s accepted that for technical and economic reasons they are highly unlikely to ever be extracted.

-A typical gas/oil drilling operation will not extract all the oil, 35% is about the typical industry average these days.

-We cannot extract such resources at any arbitrary rate of our choosing, shale gas is unlikely to match even America’s internal gas consumption (currently it seems to be topping out at about a 1/3 of US gas use). At best it will reduce (tho not eliminate) their dependence on imports for a few years. Shale oil in the US is unlikely to ever exceed 1/10 of the country’s oil consumption.

-The carbon footprint of such resources is substantially higher than conventional fossil fuels. We already have more than enough fossil fuels in conventional proven reserves to cause dangerous climate change if all of them were used.

http://www.carbontracker.org/wastedcapital

-The environmental footprint is higher too, inevitably cause more friction with neighbouring communities.

-The potential energy extractable via renewables vastly exceeds the world’s entire energy consumption by a considerable margin. It’s the thorny issue of building and installing all the kit and who is going to pay for it all that’s the problem!

Security of supply

The bulk of the UK’s imported gas comes from Norway, not Russia. The suggestion that a NATO ally could be hostile to the UK is quite frankly ludicrous.

Economic benefits

And indeed the Norwegians have extracted maximum potential benefits from their fossil fuel reserves by nationalising the entire industry. It’s odd how the advocates arguing in favour of shale gas, don’t seem keen on that one…perhaps cos they know it would mean the likes of Cuadrilla or Halliburton being run out of town!

Furthermore, the economic benefits of renewables have been long proven to exceed those (in terms of job creation, etc.) for oil or gas exploration, just look at Germany.

http://www.ucsusa.org/clean_energy/our-energy-choices/renewable-energy/public-benefits-of-renewable.html#jobs

I’ve yet to see any hard proof that Shale gas extraction would lower bills in the UK or lower taxes. The balance of probability is it will have little to no net effect, indeed given that it would reduce imports (and imported fuels tend to be cheaper and raise tax revenue) it might even have the opposite effect.

Finally, there is a need to switch people out of the myth of shale gas as the snake oil that will cure all of our ills. This is making the pursuit of alternatives all but impossible and is directly leading to countries like the UK rowing back on prior commitments as regards climate change. Switching to shale gas is like a heroin addict arguing he’s getting clean by giving it up & then switching to crack cocaine.

The reference to the British Geological Survey is here:

http://www.bgs.ac.uk/shalegas/#ad-image-0

Its an estimate of gas in place, with a median value of 1329 tcf, and is therefore subject to all the caveats about recovery rates, conversion values etc., indeed whether any shale gas in the UK can be economic; but it only covers about one third of the UK.

Two points, firstly the caveats are important, as it is pure speculation to imagine how much of that gas can and will actually be produced. I could for example counter by pointing out how much coal the UK has (yet its unlikely it will ever be mined) or calculating how much energy we receive from the Sun each day or how much energy is trapped in the form of geothermal heat under our feet. Even in a dull overcast and not particularly geologically active place like the UK, I can assure you that said resources will easily exceed this shale gas reserve by some significant margin…of course its the thorny issue of extracting all that renewable energy that’s the problem! Large reserves of energy do not automatically mean large rates of production. If they did renewables would have won this debate hands down some time ago.

Secondly, if you read through the report you’ll notice that the bulk of references are to information published between 1980 & 2000’s. There’s a few new publications from 2010-2012, but the study has essentially been more a case of fine tuning past estimates, which varied alot depending on who you asked. This is an important point to make as there is a myth that Shale gas is some new thing that nobody knew about until recently. Not true, I’ve seen academic references to it (not in this paper, but others) going back to the 1930’s. The problem in the past was that nobody was entirely sure how much Shale/Tight oil/gas was available and it was generally thought of as not being economically viable to extract.

I specifically recall Colin Campbell, the prominent peak oil “pessimist” discussing tight oil/gas prospects in his 1990’s study. He concluded that yes there was lots of gas and oil out there in this form, but only a fraction of it would ever be economic to extract. And it could never hope to match the production rates of conventional oil and gas and thus even in the most optimistic scenario it would merely delay the inevitable by a few years.

Pingback: A Global report card for renewables | daryanenergyblog

Pingback: The fracking snake oil cult | daryanenergyblog

Pingback: Putin a sock in it – the consequences of Crimea on European energy | daryanenergyblog